Swell L2 is now at 1.2 Billion in pre-deposits. What exactly are we building?

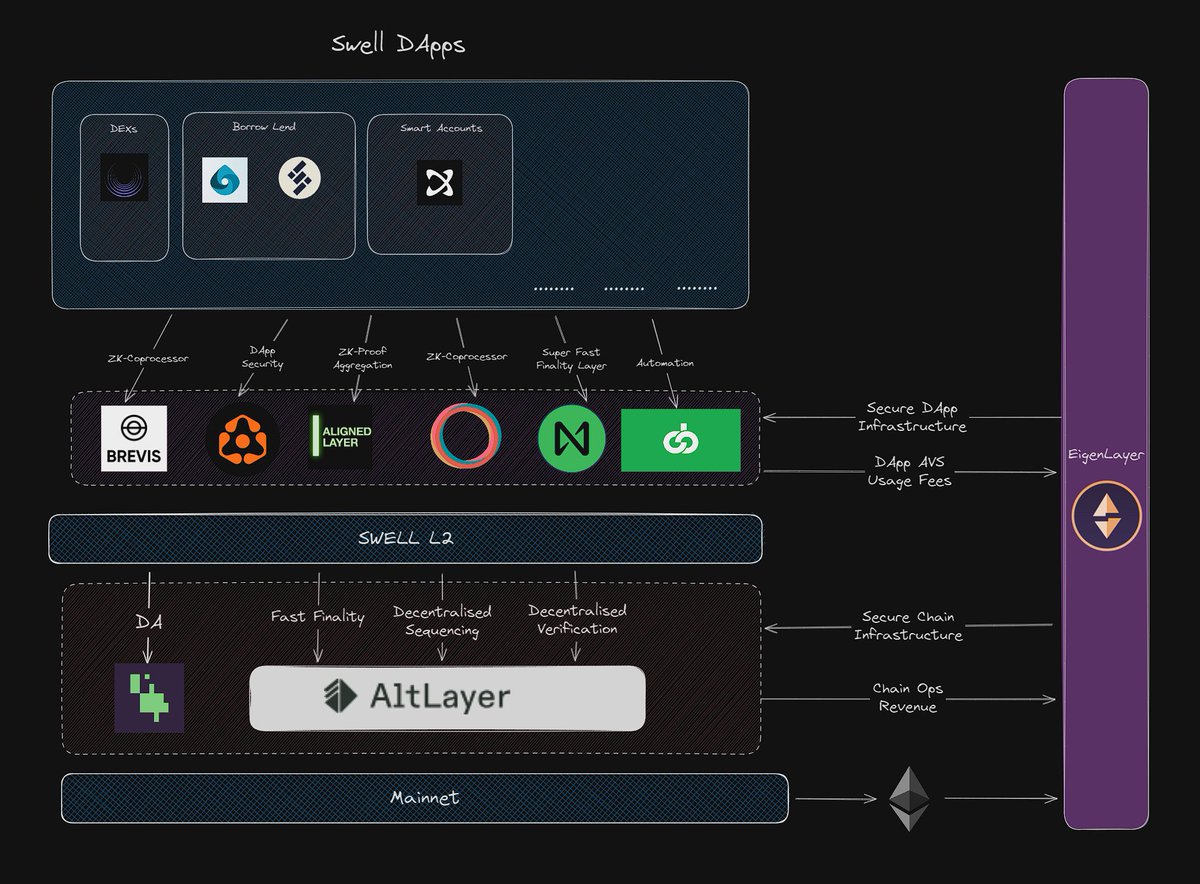

@eigenlayer is a security marketplace. LRTs are liquid representations of security. When we were building our LRT, we didn't simply want to be suppliers. Swell L2 is how we unlock the demand flywheel for the security within $rswETH

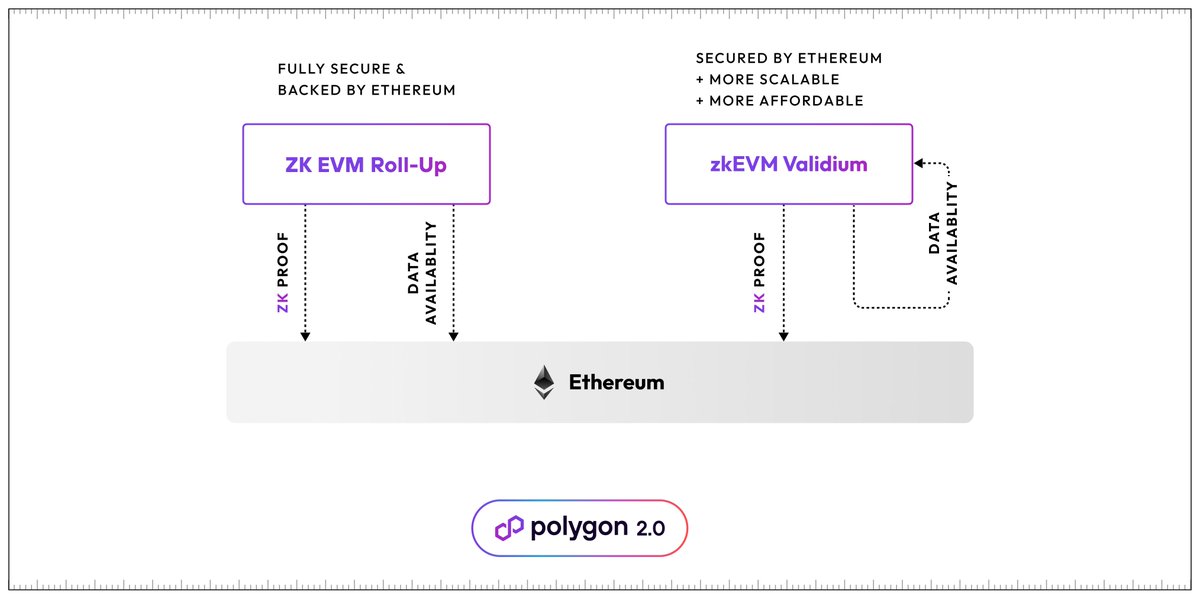

What is the L2? Swell L2 is a ZK-Validium built on the Polygon CDK. We leverage tech built by 3 industry leaders @0xPolygon, @alt_layer and @eigen_da to build the hub for the next generation of DeFi. Here's how we use each of them

The Polygon CDK is used by @okx, @Immutable, @gnosispay here's why its becoming the clear choice for many

1. No fee extraction. The Optimism Superchain has a 15% cut on sequencer fees. Polygon takes 0 cut on chains built on the Polygon CDK. So what is Polygon's motivation? 2. Polygon's biggest bet at the moment is on the network effects of the Agg Layer. Connecting all chains

By building Swell L2 as a ZK-Validium, we are able to greatly reduce the fee differential between ZK and Optimistic Rollups(especially post blobs). ZK-Validiums greatly reduce gas fees by using something that isn't mainnet for DA. Before DA solutions like Celestia and @eigen_da

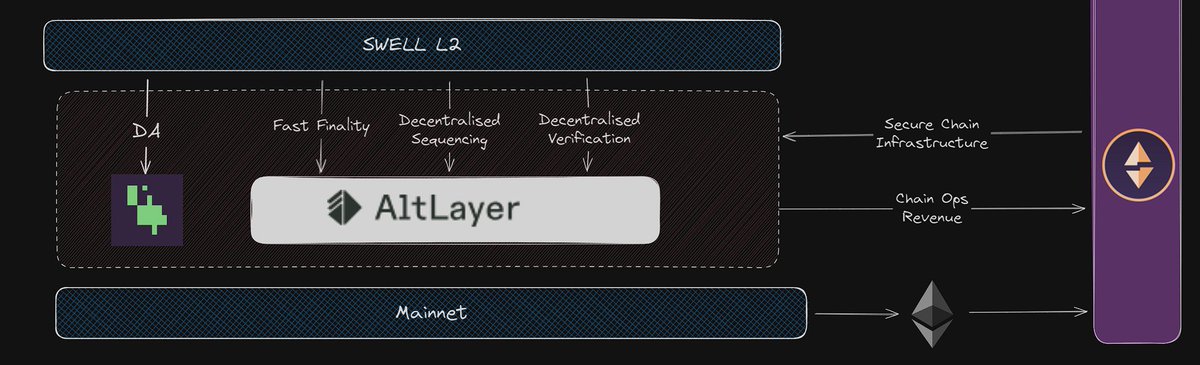

But by combining $rswETH and Eigen DA, Swell L2 is able to derive DA security from its own gas token. We bake DA security into the "ETH" of the chain, removing the need to bootstrap an entirely separate DAC and the need to pay rent to an external DA solution like Celestia

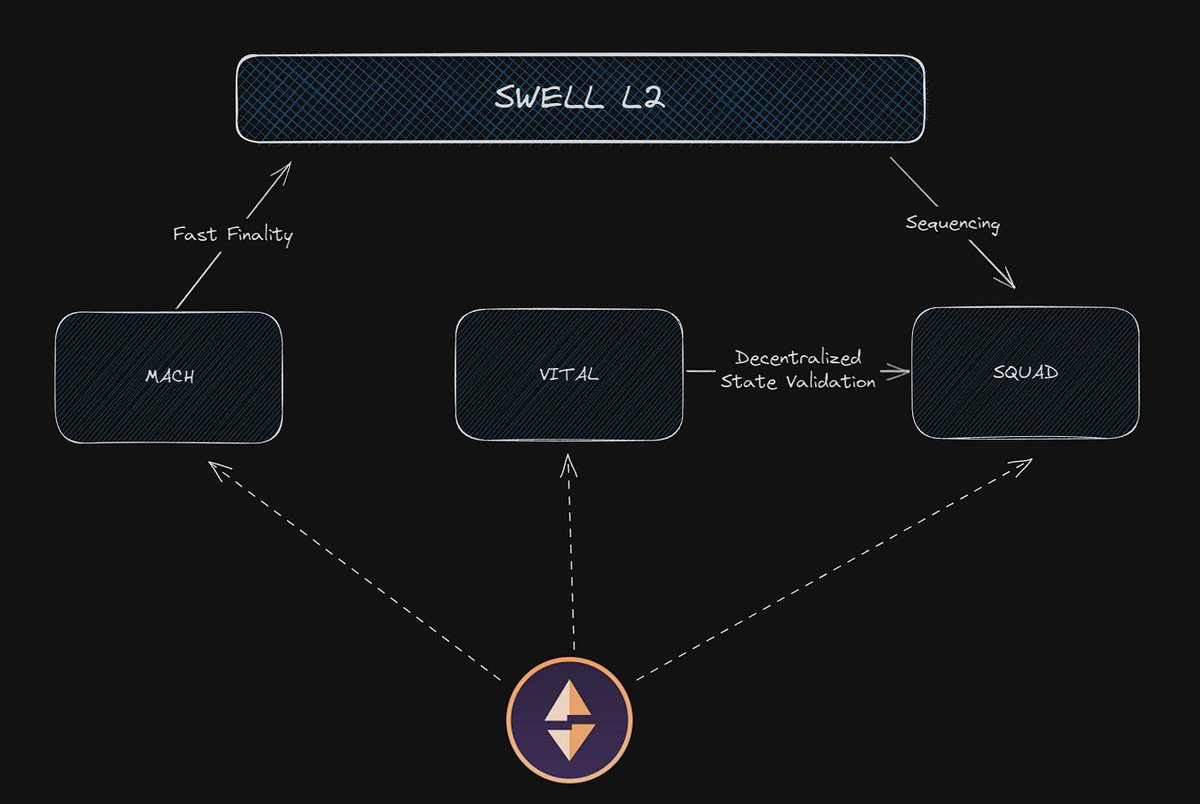

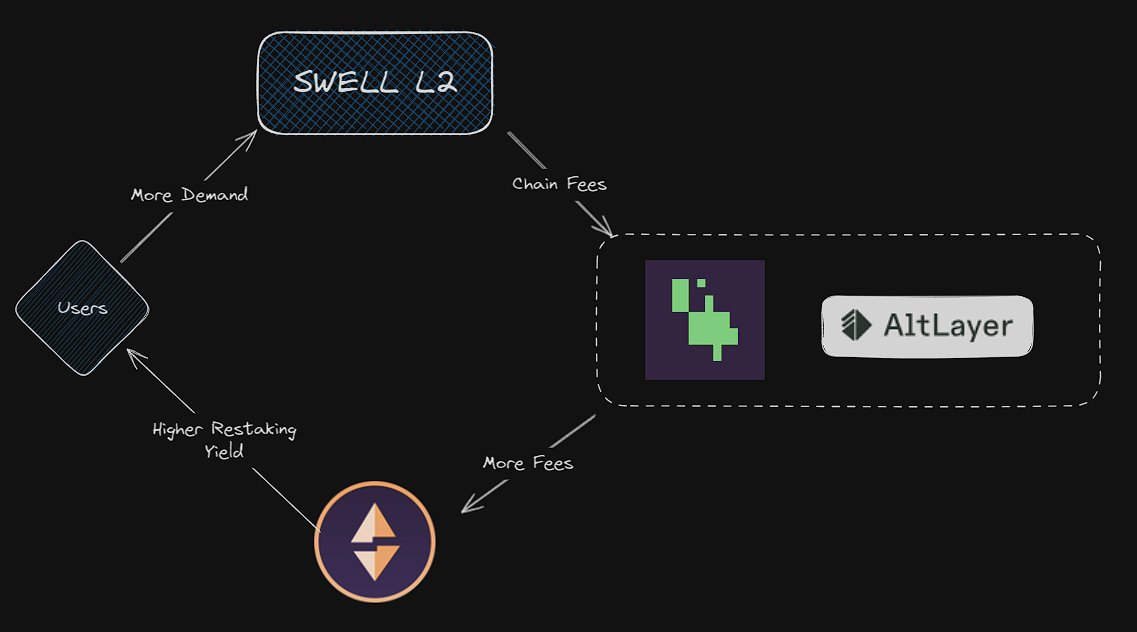

We extend this by using @alt_layer's AVS stack to achieve fast finality, decentralized verification and decentralized sequencing. $rswETH is now directly tied to Swell L2, where decentralized chain infra built by @alt_layer feeds back into $rswETH

Chain Activity drives fees to chain infra AVS's which drives fees to $rswETH which gives users higher yield which ultimately brings more users on-chain. Welcome to re(3,3), the re-staking flywheel

More Schizo thoughts coming