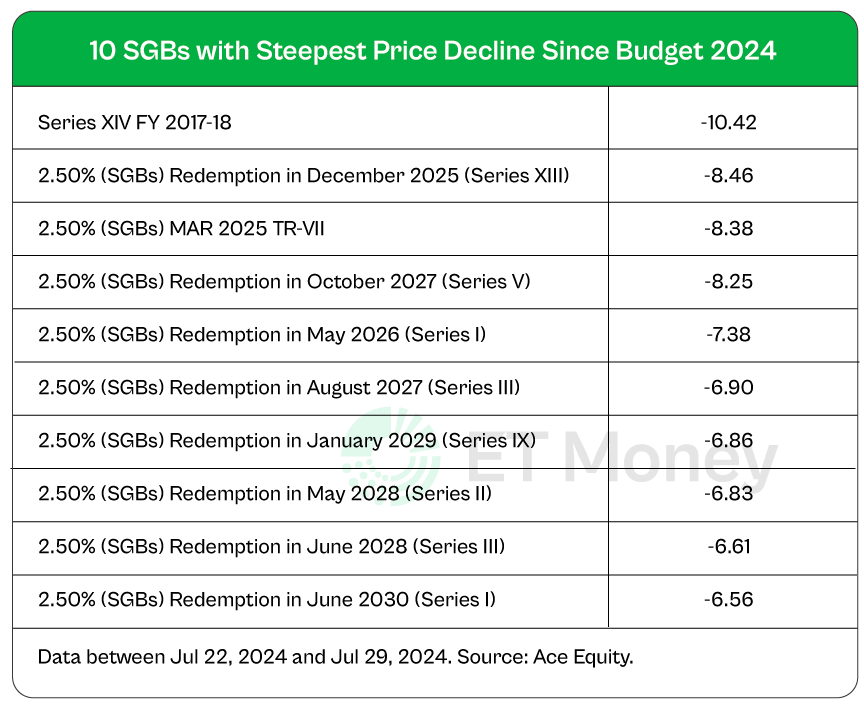

Since the Budget, Sovereign Gold Bonds (SGBs) have fallen up to 10%. Reason: Customs duty reduction on gold (from 15% to 6%). Sentiments changed. Earlier, investors believed SGB was the way to invest in gold. Now, many think it’s the worst investment. Is that really the case? A🧵

First, let’s understand what has happened. In the recent Budget, the government proposed reducing customs duty on gold from 15% to 6% (effective 24 July 2024). Indian gold prices are international gold prices converted in rupees plus taxes such as customs duty. So, when taxes

SGB prices are linked to domestic gold prices. The RBI calculates the SGB price based on the average of the closing gold price (of 999 purity) over the previous three business days from the redemption date. So, naturally, a fall in domestic gold prices will reflect in SGB’s

Take the case of 2.75% GOLD BONDS 2024 Tr-V. This issue is quite close to its maturity (due on Sep 30, 2024). Its traded price has dropped more than 5.28% between Jul 22 and Jul 29. If domestic gold prices continue to drop, investors of this bond will fetch lower returns.

Does that mean SGBs are no longer an attractive option? Not exactly. Reduction in customs duty has impacted the prices of all gold instruments. On average, SGBs declined by nearly 6% between Jul 22 and Jul 29. Gold ETFs also saw a fall of around 6%. After all, these

SGBs are still one of the best ways to invest in gold for 2 key reasons: All gains on redemption (after 8 years) are tax-free. Along with capital gains, investors earn an interest of 2.5%-2.75% annually on the issue price. No other instrument provides these benefits.

Example: Say you invested in 2.75% GOLDBONDS2024Tr-V on September 30, 2016. Redeemed it on July 29, 2024. Despite over 5% fall between Jul 22 and Jul 29, your returns (XIRR) would have been 12.94% (this includes the periodic interest from SGBs). In comparison, Nippon India

Clearly, SGBs have an edge. But there is one problem. An SGB issue matures after 8 years. So, if gold prices are falling, you don’t have the option to stay invested in them for some more time till they recover and then exit at a price point of your choice.

You have to redeem the maturing SGB at market price and wait for new tranche or invest in existing tranche through exchanges. Now, RBI comes with fresh issues of SGBs from time to time. But this year, there are no clear details of upcoming issues till now.

Theoretically, you can buy old issues from exchanges. But in practice, their trade volumes aren’t always sufficient. So, you may have to pay a premium while buying and sell at a discount. All in all, if you want to invest regularly in gold, SGBs may not be a great option.

What other options do you have? To invest regularly in the yellow metal, ETFs or gold mutual funds can be a handy option. Especially after Budget 2024, as the tax on the same has been reduced.

Earlier, gains from gold funds were added to income and taxed as per your slab rate. Now, short-term gains (a holding period of less than 2 years) will be taxed at slab rate. Long-term gains (after 2 years) will be taxed at 12.5%. So, gold funds are now a lot more attractive

If you find this useful, show some love. ❤️ Please retweet the first tweet.

Since the Budget, Sovereign Gold Bonds (SGBs) have fallen up to 10%.

— ET Money (@ETMONEY) August 1, 2024

Reason: Customs duty reduction on gold (from 15% to 6%).

Sentiments changed.

Earlier, investors believed SGB was the way to invest in gold.

Now, many think it’s the worst investment.

Is that really the… pic.twitter.com/FgF9GWikrp