This is Howard Marks. He built Oaktree Capital Management into a $180,000,000,000 powerhouse. On October 12, 1990, he published his first memo. Now, they're the first thing Warren Buffet reads. Here are the 7 key takeaways from 50 years of legendary experience:

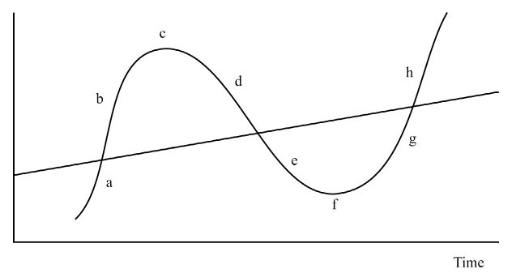

1. Cycles are inevitable: Market cycles are an inherent part of the economic and investment landscape. Recognizing this cyclical nature is crucial for investors.

Howard talks a lot about cycles. He credits understanding the credit cycle as one of the most important factors in his success.

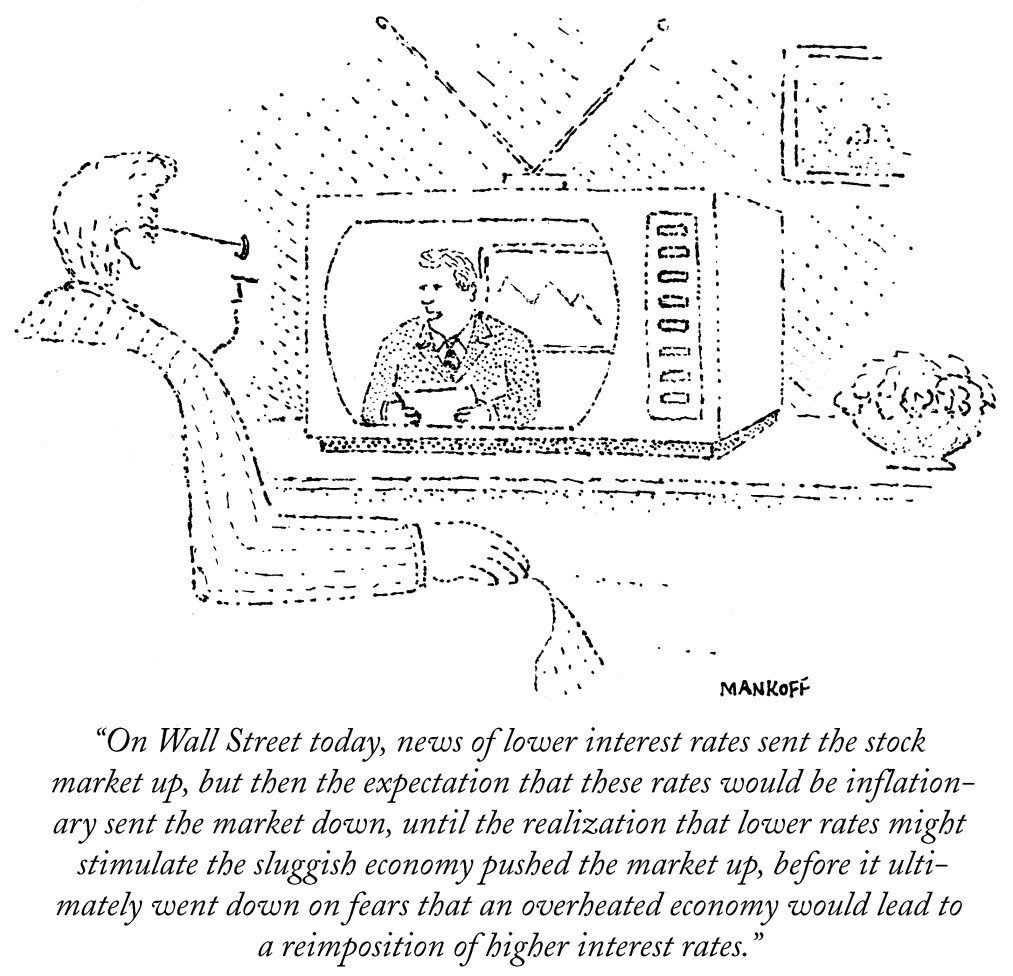

2. Psychology drives extremes: The most significant deviations from general trends are largely produced by fluctuations in investor psychology. Understanding market sentiment is key to navigating cycles.

Like most great investors, Howard considers market inefficiencies to be driven by human psychology. He was a buyer of $200M of credit *per week* during the height of the financial crises when prices were severely depressed.

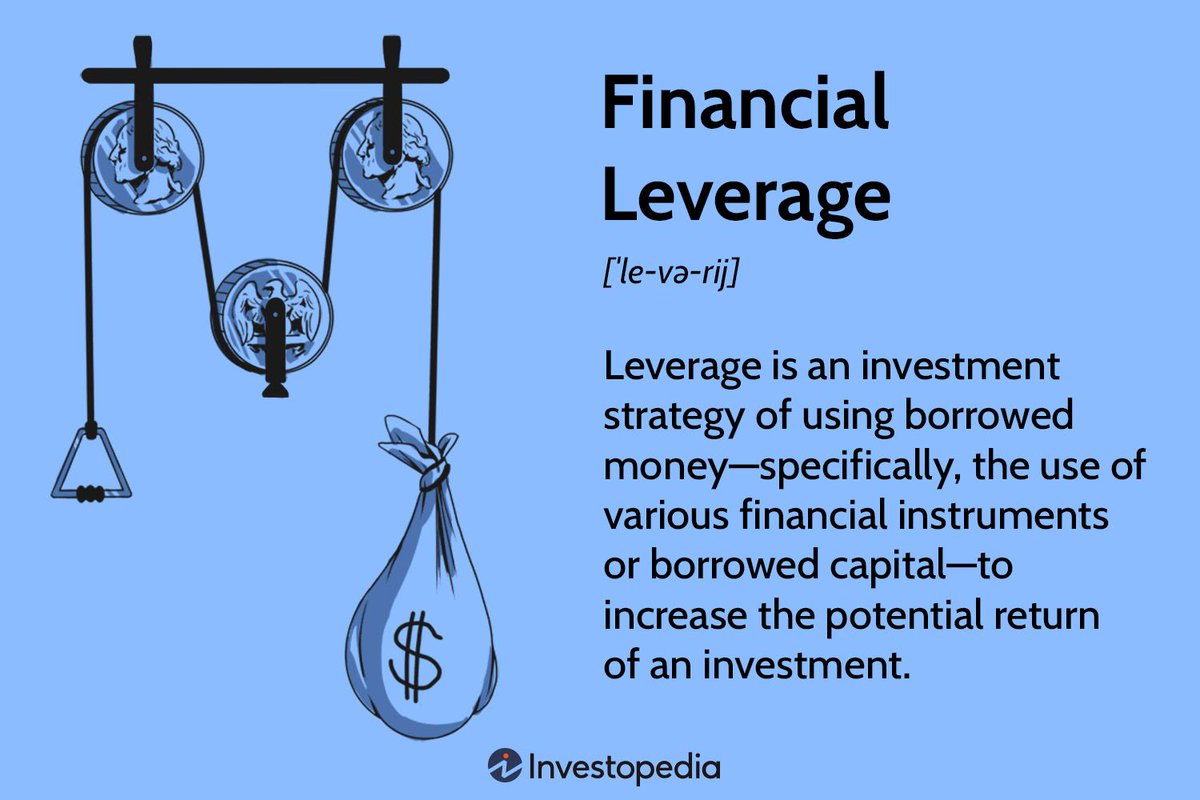

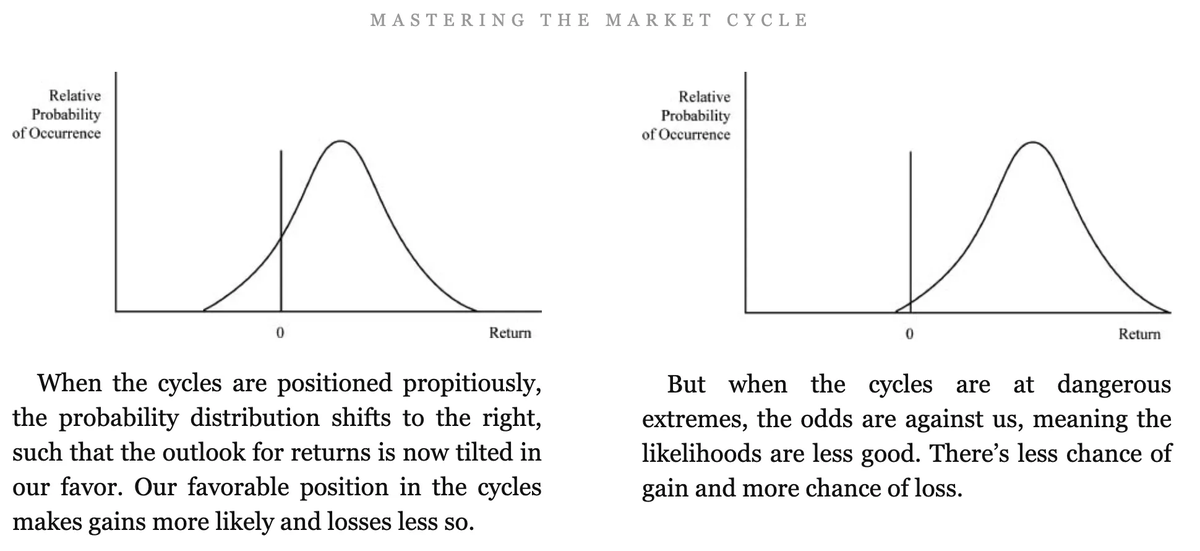

3. Positioning is critical: The greatest way to optimize a portfolio is by deciding the balance between aggressive and defensive positions based on where we are in the cycle.

Leverage is an investor's worst enemy. When the cycle is at its top, it's time to de-lever. The opposite is true at the bottom.

4. Contrarian thinking is valuable: Being able to go against prevailing market sentiments when they are driven by irrational fears or excessive optimism can lead to significant opportunities.

Superior investors can: 1/ Do the opposite as the average investor 2/ Be right in their call It goes beyond *just* doing the opposite.

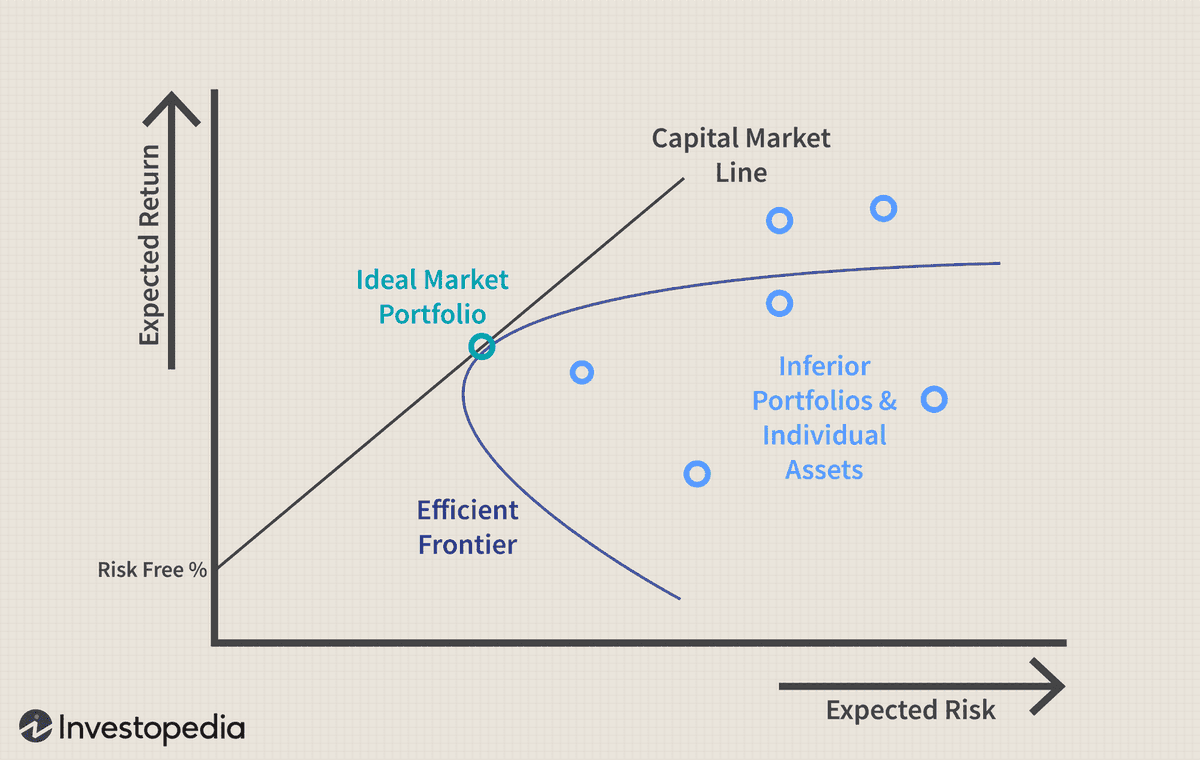

5. Risk and return are inversely related: Maximum psychology, maximum credit availability, maximum price, minimum potential return, and maximum risk all coincide at the top of a market cycle. The opposite occurs at the bottom.

As market buoyancy increases, investors demand less return for more risk. This is the best time to take risk off and look for sales.

6. Focus on probabilities, not predictions: The future should be viewed as a range of possibilities with varying likelihoods, not as a single fixed outcome that can be predicted with certainty.

7. Price matters: Marks emphasizes that no asset is so good that it can't become overpriced. Assessing how things are priced in relation to their intrinsic value is crucial for successful investing.