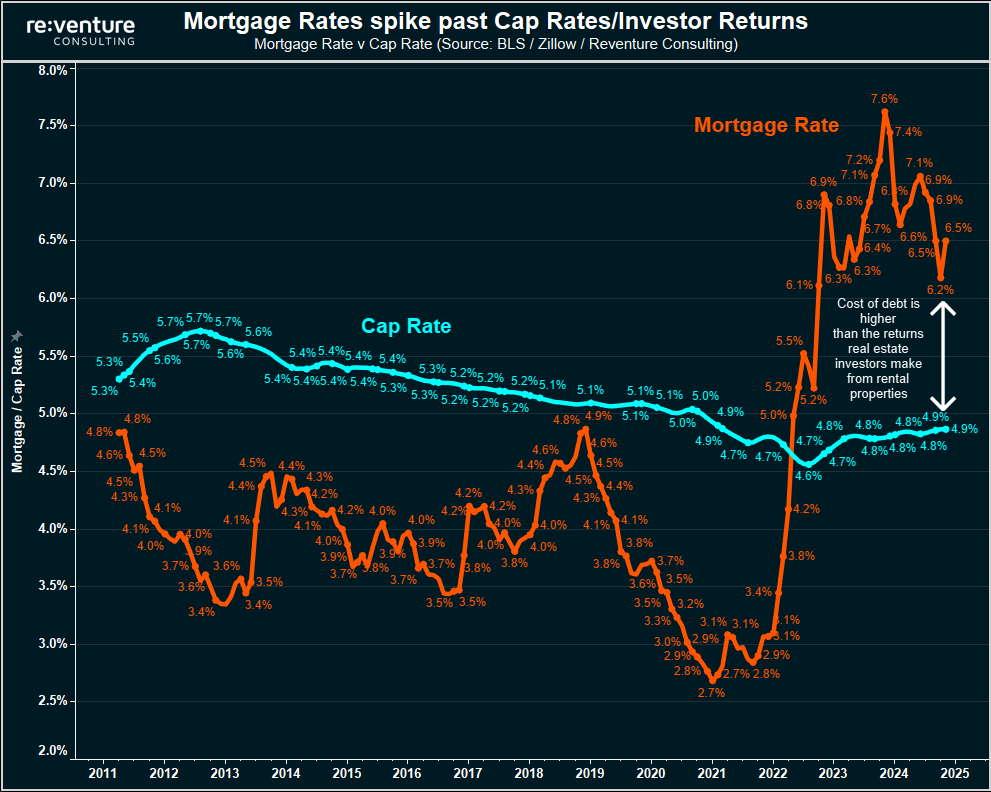

Mortgage rates spike back to 6.8%. The disconnect between mortgage rates and real estate investor returns has never been greater. Expect institutional investors to continue selling houses, and for inventory to keep increasing in the South especially.

1) The principal problem for real estate right now is that it's not possible to make money buying properties for cash flow at current interest rates. Most investment properties only produce a 4-5% cap rate an unlevered basis. And as soon as you layer debt on top of that, the

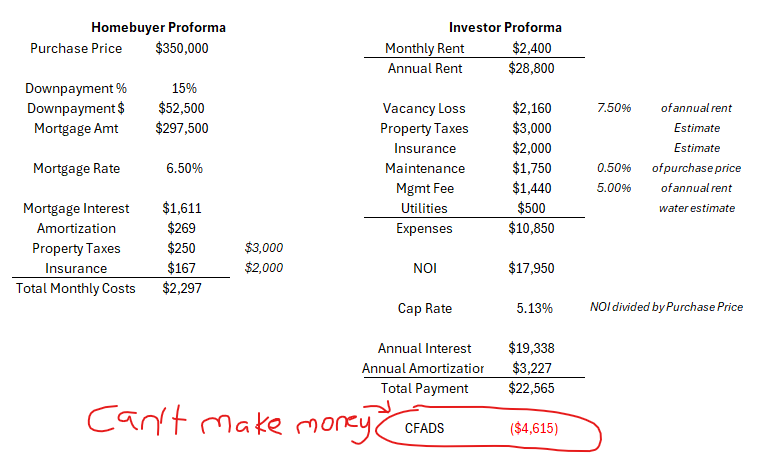

2) Here's an example of a hypothetical investor proforma. $350,000 house in Atlanta. Market rent for $2,400/month. Sounds not bad, right now? Well, after paying your expenses and your mortgage interest, you lose $4,600 per year as an investor.

3) Many rental markets across America are also struggling right now. Atlanta, Phoenix, Vegas, Tampa, Nashville, and Austin are all soft, with declining rents in many cases. In that environment, what incentive would an investor have to buy?

4) As a result, many investors are beginning to unload their properties, because they see the writing on the wall. Take a look at this listing in Atlanta. Owned by Progress Residential. 2,600 SF house listed for $299k. Couldn't get the rent they wanted, so they're selling.

5) I think a lot of people underrate the impact this will have on the housing market. According to ATTOM Data, there's 24 Million investor-owned homes in America. Basically 25% of the entire single-family housing stock. Many of those investors bought in last 2-3 years, and

6) We're already seeing reduced investor buying, and increased selling, reflected in inventory statistics. In almost every large market across the South - Dallas, Atlanta, Nashville, Tampa, Orlando - inventory has spiked most in investor dominated ZIP codes.

7) Check out Houston. Massive inventory surplus now present in north, east, and southeast neighborhoods (red ZIPs). Inventory now up 50-100% from long-term norms. Meanwhile, still an inventory shortage (blue ZIPs) in higher income areas with predominantly owner occupants to

8) The big mistake people make in thinking about investors' impact on the housing market is that's it's a global or national phenomneom. Rather - it's market specific. And neighborhood specific.

9) Going back to the map of Houston, we can see, not surprisingly, that home values are now going down most in those same investor-dominated ZIPs to north, east, and southwest (blue color now). Seasonally-adjusted, monthly price drops of -1.0%. Which is a lot. Meanwhile, lower

10) If you're a homebuyer or investor, you really need to inform yourself on the local trends showing up in your city and ZIP code. Is inventory rising or falling? What are the recent price trends? And where could prices head in the future given these variables? Access the data