The art of knowing when to go breakeven🎨 A logical approach on where to go breakeven

When you are in a trade, it is very important to know when the market can going against your trade idea. In this thread let us see how can we anticipate the movement of price going against us and avoid losing money as much as possible.

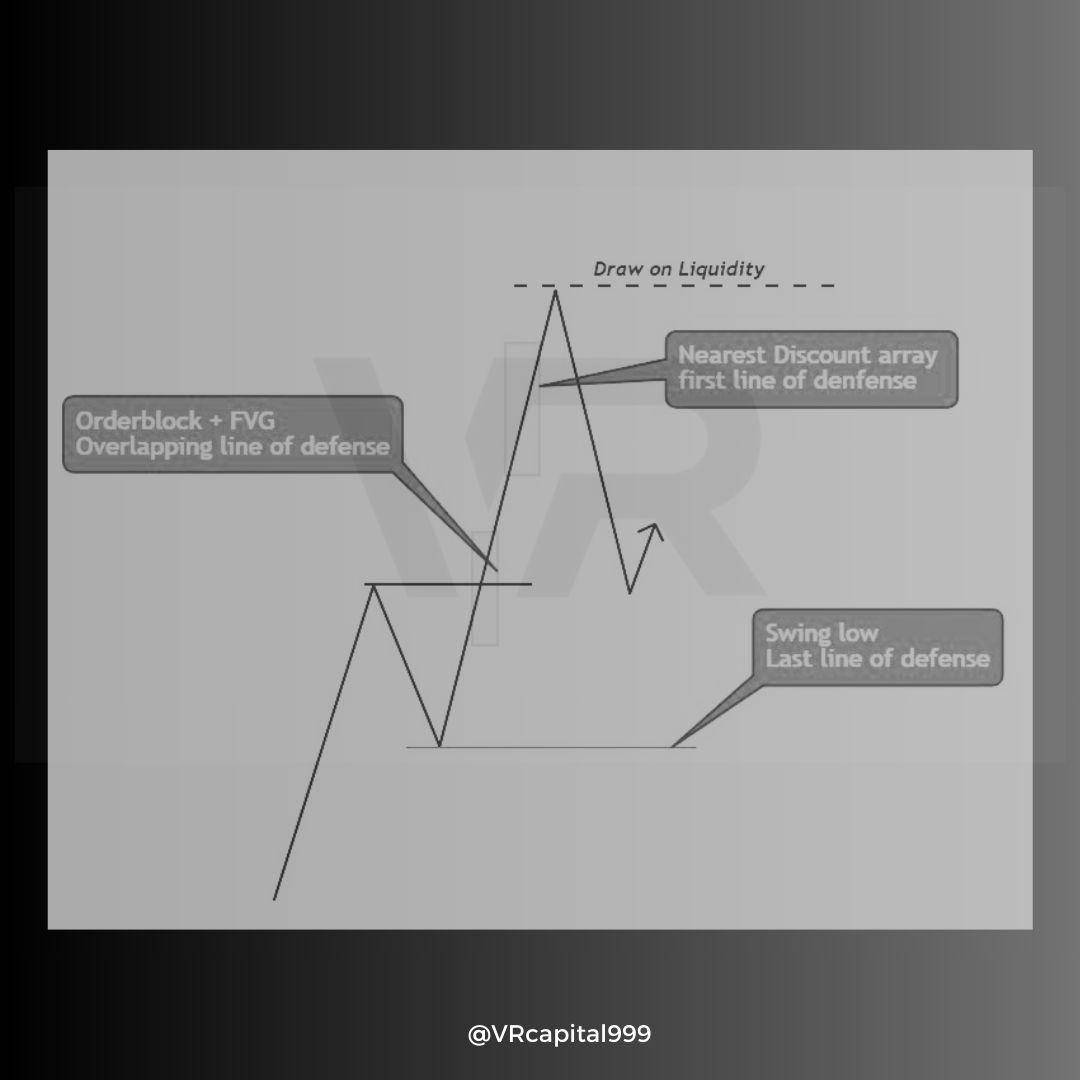

Firstly, we have to understand- FLOD( first line of defenee) LLOD(last one of defense)

FLOD- When we are targeting a premium array, we will be looking to trade from a discount array. FLOD (First line of defense) is the first discount array that price can use to displace, targeting the premium array

LLOD- The last line of defense is the last discount array that price can use as a discount array to target the premium array. The last line of dense is always a swing low.

Once price uses one of the discount arrays to displace and creates a new orderflow leg, the old FLOD and LLOD are no longer valid. In the New orderflow leg ,mark all the discount arrays that price can use to even displace higher.

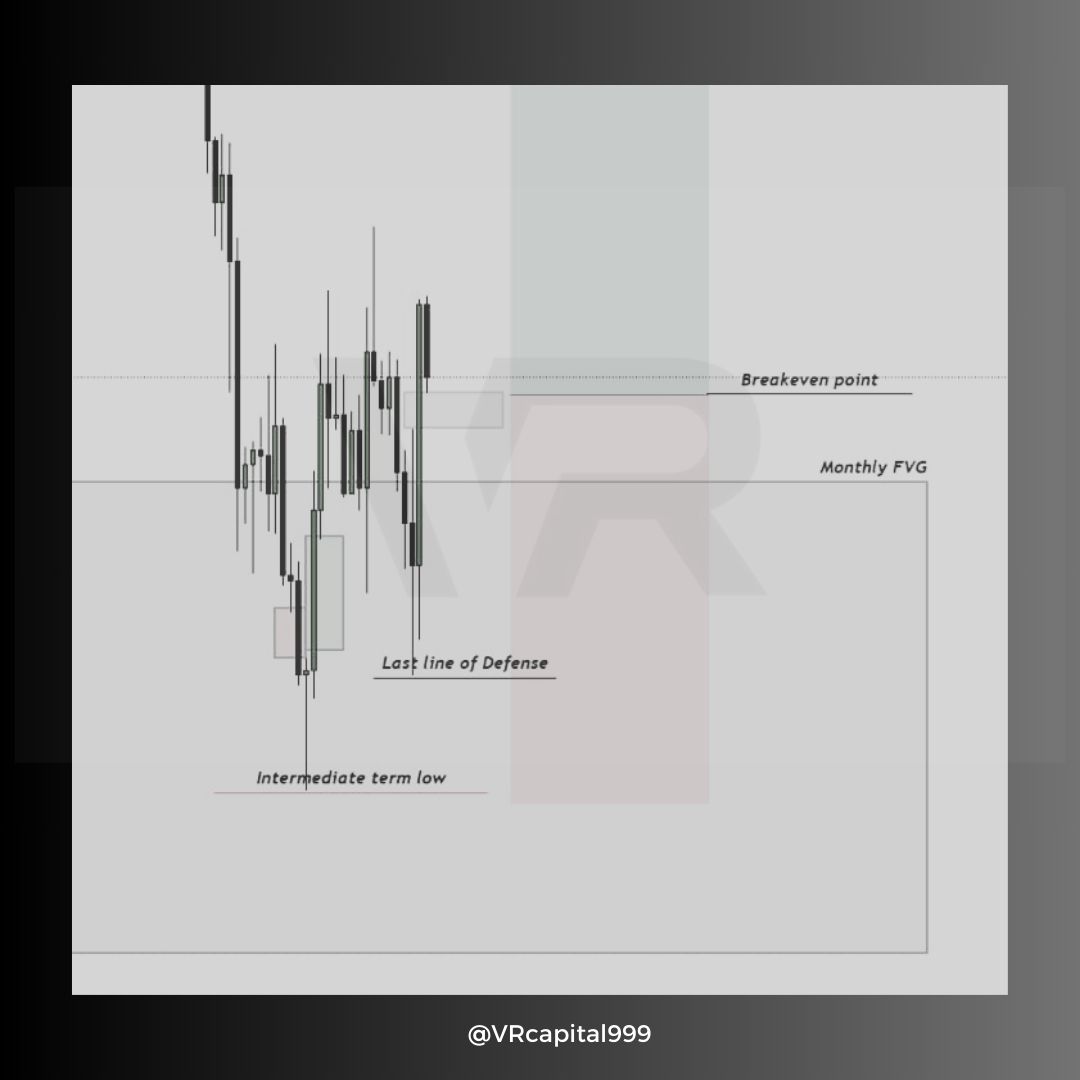

To go breakeven on a trade idea, we have to give price the maximum space to retrace before displacing further. So, we should MAKE SURE TO GO BREAKEVEN ONLY WHEN THE LAST LINE OF DEFENSE(LLOD) IS ABOVE THE BREAKEVEN POINT

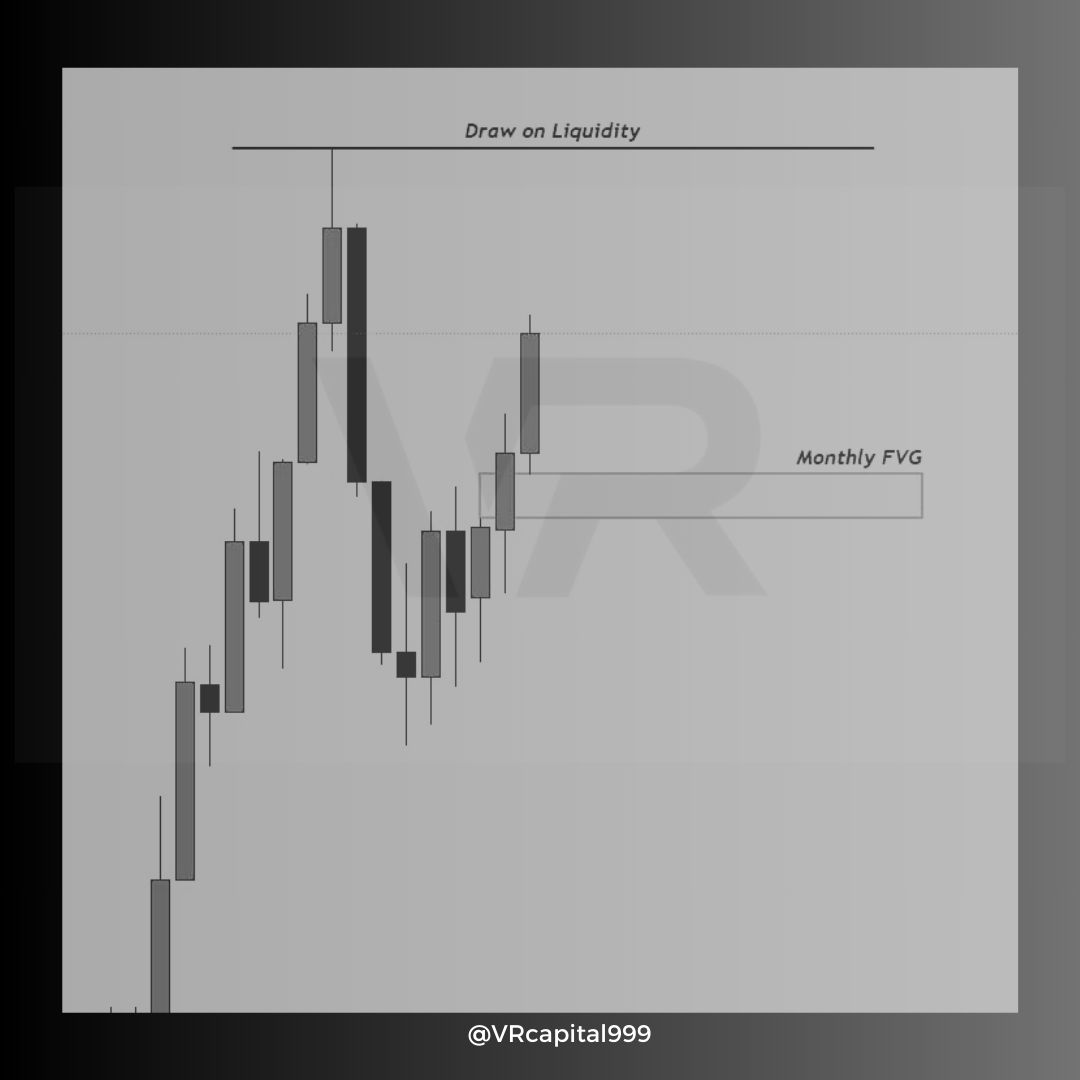

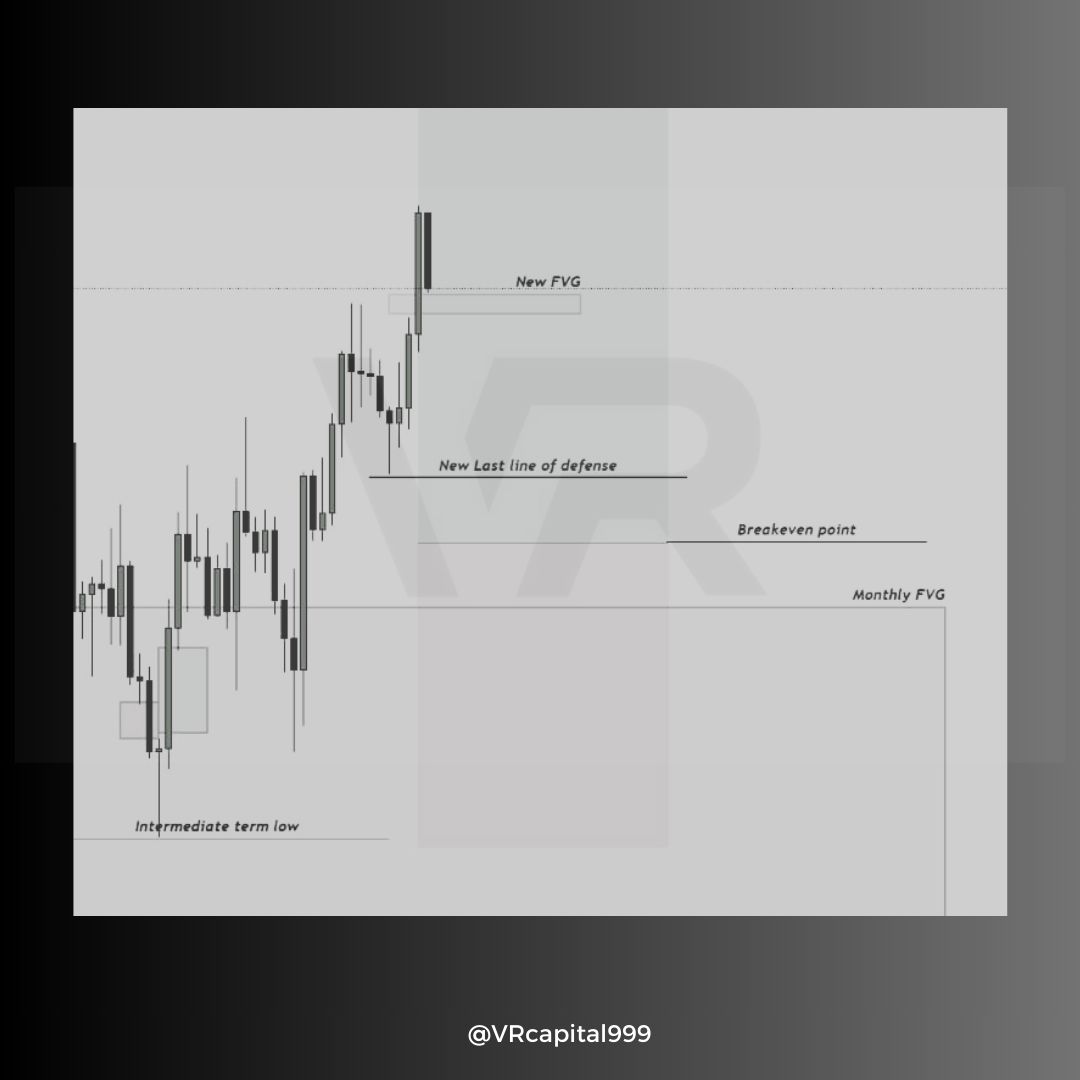

Once price breaches the LLOD, it is an early indication of price reversing on us and we could see a change in order flow direction Let's see an example In this example in USDJPY, we have the Monthly FVG from where we can trade to the Draw on liquidity as our trade idea

So we go to the H4 timeframe to find Sharp turn + new FVG as it is our entry pattern to enter from a Monthly PD array in the Once we get the Sharp turn which creates a new H4 FVG, gives us the signal to enter a long trade covering the intermediate-term low

Once we create another H4 FVG, the LLOD is the new swing low. As we can see, we cannot go breakeven now as we have to leave price the space to retrace until the LLOD Once we create yet another orderflow leg with H4 FVG the LLOD again shifts higher.

Using LLOD, trade management becomes logical and mechanical. The key difference between a usual swing low and LLOD lies in the presence of an FVG in the order flow leg. Follow for more insights! Share topics below! ❤️